US Reopening: Slow and (Hopefully) Steady

By datatrekresearch in Blog

Today we’ll do our usual weekly “global traffic congestion as economic indicator” analysis based on crowdsourced TomTom GPS data, but first we want to put some capital markets context around this conversation:

- The US equity “reopening trade” has clearly sputtered in the last 2-3 weeks. Treasury yields have stopped rising. Bank and energy stocks, along with the Russell 2000, have hit something of a brick wall.

- Many of the sectors that led in 2020 have had a renaissance. The S&P Tech sector is within 0.2 percentage points of its February high. Google made a new high today; Facebook is close behind. Amazon is up 9 percent from its March YTD lows.

Sure, there’s some reversion to the mean happening here. Cyclicals ran fast and heavy and likely need to show good Q1 results and guide analysts to higher earnings estimates. Fair enough.

But there’s also a creeping realization that the “reopening trade” has some wrinkles in it. Home Depot made another new high today and is up 19 percent YTD. Stop by any store and you’ll see why. Americans aren’t saving their stimulus checks for travel later this year. They may still hit Disney this summer and see the grandparents for holidays, but 2020’s habits of cocooning and working from home are not dying quickly. Not even close …

Traffic congestion data from Houston and Phoenix, which should be leading-edge reopening cities given Texas and Arizona’s early return to pre-pandemic regulations, tells the story.

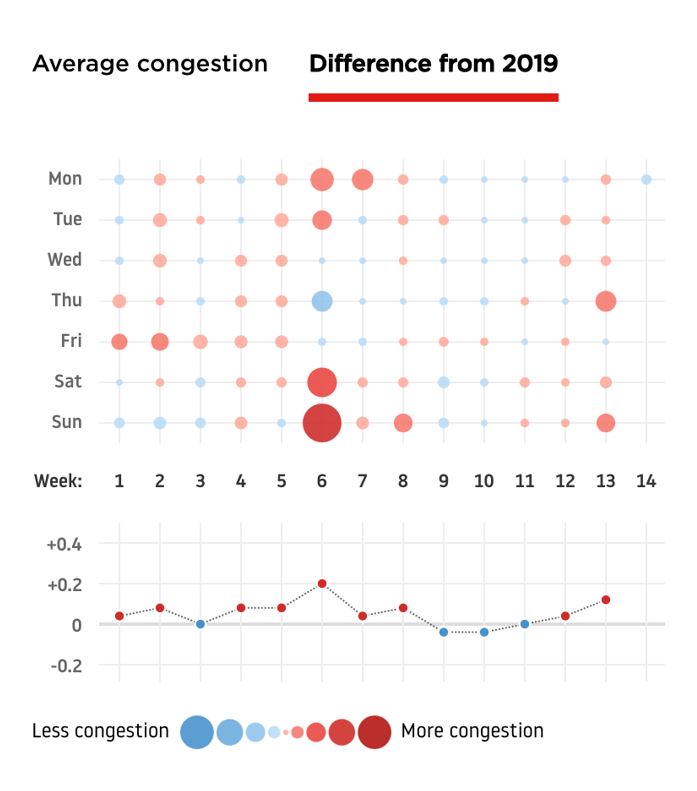

Here is TomTom’s 2019 – 2021 comparable traffic congestion data for Houston, presented on a weekly basis back to the start of the year. The blue bubbles show 2021 days with less congestion than 2019, and the line at the bottom is the aggregate weekly comp. Last week’s Houston traffic, for example, was 20 percent below 2019 mean levels.

We see exactly the same pattern in the Phoenix data, where recent weekly comps are running down 20-25 percent. Both Texas and Arizona may show some better comps this week since Easter 2020 was a week later, but you can see that recent trends are overall fairly lackluster.

Shifting gears now to how the global economy is recovering, Europe is going through another round of lockdowns so the continent’s traffic data doesn’t add anything to what we already know. France, Italy and Germany are all going to be very quiet for weeks to come.

Congestion data does, however, illuminate something useful about the tech-based parts of China and Taiwan’s economies.

This is Shenzhen’s 2019 – 2021 comparable traffic congestion data through today, with last week’s comp at -35 percent. This city is an important Chinese tech hub, home to Huawei, Tencent, ZTE and drone maker DJI among many other local technology champions.

Now, here is Taipei, where the latest comp to 2019 was -12 percent but, as the line chart shows, we’ve seen positive comps as recently as a week ago.

And here is Tainan, where Taiwan Semi has 3 of its 8 major Taiwanese fab plants; traffic congestion here has been at least as high in 2021 as it was in 2019.

Takeaway (1): assuming Houston and Phoenix are emblematic of how quickly/robustly other US cities will return to pre-pandemic normal over the course of 2021, we could be in for a slower return to 2019 economic levels than the snapback that was consensus just a few weeks ago. From a stock and sector performance perspective, that should not matter over 6-12 months. A demand and earnings recovery will still happen, albeit at a slower pace than previously expected. But the cyclical groups we mentioned at the top of this section, many of which we still like, will have to sing for their supper just a little bit louder.

Takeaway (2): A slower pace of US economic recovery is actually good for US stocks overall because it keeps interest rates lower and that gives some oxygen to large cap Tech (still +35 percent of the S&P 500).

Takeaway (3): if the US does really bounce back more slowly than previously thought and Europe is at least 2 quarters behind America, then export-driven economies like China are in for a disappointing 2021. Taiwan, with a specialization in semiconductors and a strong US customer base, is a better place to be as an investor.